Budget Incentives for Investors: Includes Tax Exemptions

The government has undertaken various programs, including tax exemptions, for the improvement of several sectors.

For the upcoming fiscal year, a new bill related to crop cultivation has been introduced in the budget. A program to determine the eligibility criteria for the appointment of the Revenue Chief has been initiated.

Some of the tax exemptions provided in the past have been withdrawn. For instance, the tax imposed on potato and onion has been withdrawn from last year.

The following are the provisions related to agriculture and revenue mentioned in the budget speech:

- A new bill related to crop cultivation, farming, and herding has been introduced to facilitate and promote these activities. This will help improve the efficiency and effectiveness of the Crop Cultivation Management.

- The cost of the abandoned land will be reflected in the government’s financial statement, and a provision has been made to simplify the land expenditure procedure.

- A provision has been made to provide tax exemptions to the investors through a medium of concession or exemption while making new development agreements.

- To attract consumers to the billing system, a provision has been made to increase the value of the bill by 10% and provide it to the consumers from the coming Shrawan. The problems encountered in the implementation of this provision will be resolved.

- A provision has been made to expand the use of an automated system to ensure consistency and transparency in the financial and transactional information provided by banks and financial institutions.

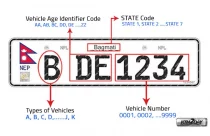

- A provision has been made to develop a system that allows the taxpayer to obtain a QR code-based tax receipt by themselves when they need to provide it, and the taxpayer does not have a pending tax.

- A legal provision has been made to require the use of electronic or QR code-based methods for the collection of revenue in business transactions.

- The Minister of Finance has mentioned that the list of goods and services subject to tax exemptions will be revised, the tax system will be developed, and tax exemptions will be provided on some goods.

- Taxes have been imposed on the import of potatoes, onions, and ginger, and the prices of these goods have increased.

- The excise duty rates on alcohol, beer, tobacco, and Cigarette have been increased.

- The threshold for value-added tax (VAT) has been increased from the current 2 million to 3 million to facilitate the operation of mixed businesses.

- A provision has been made to implement an arrangement to reduce carbon emissions in the import of petroleum and coal products as per the international commitment.

The government has introduced new bills and programs to promote and facilitate crop cultivation, farming, and herding.

The government has also made provisions to simplify the taxation and revenue collection process and increase transparency and consistency in the financial sector.

Additionally, the government has imposed taxes on certain goods and services and withdrawn tax exemptions on others.