Budget of 1.53 trillion unveiled for fiscal year 2019/20

Finance Minister Yubaraj Khatiwada today presented Rs 1.532 trillion federal budget of fiscal 2019-20 in the joint session of the House of Representatives and National Assembly, with due priority to infrastructure development.

The second federal budget has laid high emphasis on development of roadways, railways, waterways, hydropower and airports, and has projected that the country’s economy will grow at 8.5 per cent and inflation will remain below six per cent in the upcoming fiscal.

The government has also expressed its commitment to complete major projects, including Melamchi Water Supply Project, Bhairahawa International Airport and Motihari-Amlekhgunj Oil Pipeline Project within 2019-20. It has prioritised completion of pending projects during the year.

HIGHLIGHTS

- Focus on infra development

- Inflation to remain within 6pc

- Elderly allowance up by Rs 1,000

- Civil servants’ salaries raised by up to 20pc

- Economic growth projected at 8.5pc in next fiscal

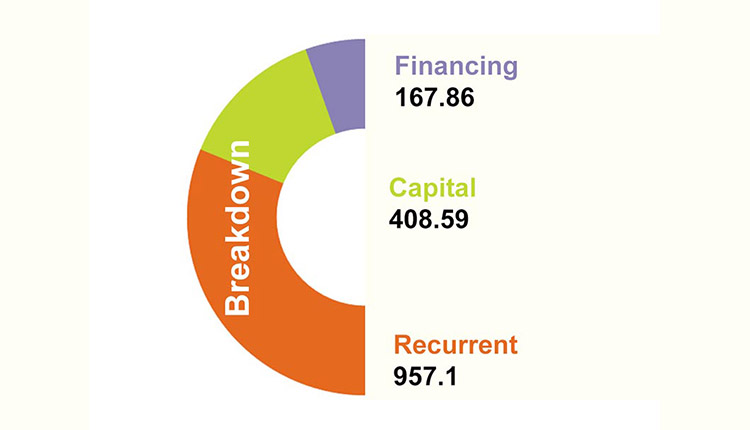

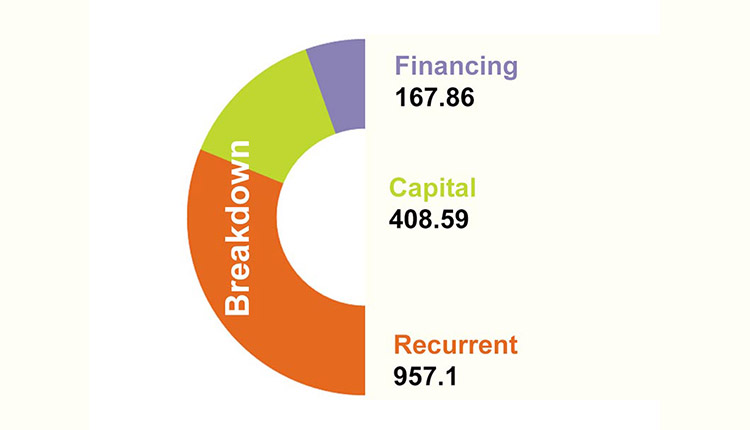

Of the total budget for 2019-20, the government aims to utilise Rs 957.1 billion as recurrent expenditure; it has earmarked Rs 408.59 billion and Rs 167.86 billion for capital expenditure and financing provision, respectively.

The budget has set federal government’s revenue collection target of Rs 981.12 billion for the next fiscal. The government plans to seek foreign grants and loans worth Rs 298.8 billion and Rs 58 billion, respectively. Internal borrowing worth Rs 195 billion is expected to balance the expenditure and source for the budget.

The budget has transferred Rs 55.3 billion to seven provinces and Rs 89.95 billion to local bodies in equalisation grants and Rs 44.55 billion to provinces and Rs 123.87 billion to local bodies as conditional grants.

Under the revenue-sharing scheme, the provinces and local bodies are expected to receive Rs 130.89 billion in the next fiscal.

The budget has given priority to domestic industries, especially export-oriented industries, generation of employment opportunities, promotion of agriculture and tourism sector and enhancement of public service delivery.

Prime Minister KP Sharma Oli-led government, which was under pressure to satisfy lawmakers and civil servants, has raised the budget for constituency development programme and increased salaries of civil servants. While the government has increased budget for the constituency development programme by Rs 20 million to Rs 60 million, salaries of civil servants have been raised by up to 20 per cent — 20 per cent for non-gazetted staffers and 18 per cent for gazetted officers.

The government has also raised elderly allowance by Rs 1,000 to Rs 3,000 per month and monthly allowance for single women, people with disabilities, Dalits and other marginalised communities has also been increased by Rs 1,000.

The budget has given continuity to health insurance worth Rs 100,000 for senior citizens.

It has also announced restructuring of the Prime Minister Agriculture Modernisation Project and effectively implementing it in the upcoming fiscal year, thereby creating more employment opportunities.

The government has announced tax of one rupee per litre on petrol and diesel for road maintenance purpose, in addition to five rupees per litre being levied for the construction of the Budigandaki hydropower project.

The government has announced it will develop nine cities, including Kathmandu, Birgunj and Biratnagar, as megacities and connect every rural municipality with at least one strategic road.

The government has also announced it will adopt policies to encourage mergers of banks and financial institutions, including insurance firms. In a bid to ensure that public enterprises operate effectively, the government has announced it will bring in strategic partners in such enterprises as per necessity.

In a bid to make effective the collection of Value Added Tax, the government has also announced a 10 per cent rebate on the VAT levied on total transaction made by a customer while purchasing goods and services through digital payments.

The government has also exempted income tax for individuals with annual income of Rs 400,000 and married couples with annual income of Rs 450,000. Previously, individuals earning over Rs 350,000 annually and couples earning over Rs 400,000 annually were levied income tax.

The government has also slashed advance capital gains tax on real estate to five per cent in sub-metropolitan cities and to 10 per cent in metropolitan cities.

Meanwhile, economist Bishwo Poudel, said the budget had followed the previous trend of being distributive in nature and had failed to adopt austerity measures necessary to ensure economic growth.

“The recurrent budget and the size of revenue collection is almost the same, which clearly shows that majority of the collected revenue will be spent on recurrent expenditure. This is not good,” he said.

However, unchanged income tax slabs and no additional tax burden in the budget are certain to encourage the business community, he added.

Provincial governments will present their budget before provincial assemblies by mid-June and local governments will present their budget 20 days before the beginning of the fiscal year calendar.

Excerpts:

- Revenue distribution: 130 bn between provincial and local levels.

- EDUCATION: Free education up to secondary level. 70 districts to be designated the status of fully literate districts.

- 2 bn appropriated for colourful textbooks for primary level. Free day-meals for 2.2 million school children.

- Free sanitary pads for female students attending public schools.

- SCIENCE AND TECHNOLOGY: Over 110 bn allocated for Madan Bhandari Science and Technology University. Science-tech lab to be established in each province.

- 6 bn allocated for free insurance service in all districts.

- HEALTH: Grants increased for treatment of 8 severe illnesses. 2.2 bn appropriated for new-mothers’ travel expenses. Rs 3000 to be provided as annual allowance to 52,000 female community health volunteers.

- 5 bn to establish health service providing facilities at local levels. 400 mn allocated for establishment of Ramraja Prasad Singh Hospital in Rajbiraj.

- 400 million appropriated for betterment of Bir Hospital.

- Absolute ban on smoking and drinking in public places.

- 92% of population to be provided full access to drinking water in the coming fiscal. 7 bn allocated for Melamchi Drinking Water Project.

- Over 43 bn budget allocated for drinking water and hygiene.

- Social security allowance to pregnant women and elderly. Senior Citizens allowance sees an increment of Rs 1000 (increased from Rs 2000 to Rs 3000).

- Employment schemes for people with disabilities.

- Coming fiscal to be marked as Youth Mobilisation Year. Youth Scientists Conference to be held in the coming year.

- AGRICULTURE: Grants in purchase of agricultural products and technology. Schemes for achieving self-sufficiency in dairy, poultry and fresh vegetables. Grants on fertilisers.

- Organic farming to be encouraged.

- Fruit cultivation to be doubled in the next 5 years. Food Quality Lab to be set in every province. 500 mn appropriated for community farming.

- 34 bn allocated for agriculture.

- A budget of 23.6 bn allocated for irrigation programmes. 960 million allocated for irrigation programmes in Tarai. Sunkoshi Marine to be developed as a National Pride Project. 2.05 bn allocated.

- 5.6 bn allocated for construction of dams.

- Next fiscal to be marked as Tree Plantation Year. Security to be beefed in forest areas. Newer practices to be launched in livestock management. 1bn for ‘Rashtrapati Chure Programme’.

- LAND MANAGEMENT: Land Management act to be introduced for sustainable utilisation of land. Encroached public lands to be brought under government within the next fiscal. Online issuance of land-ownership certificate within the next two years.

- TOURISM: Tourism sector a top priority. Stress on infrastructure for development of main tourist areas. Trail connecting Darchula to Taplejung to be developed. Operation of cable-cars to encouraged in mountainous regions.

- Government officials to gift only homemade products as and when needed.

- Private and cooperative sector to be encouraged for production of necessary commodities. Local cement and rods to be encouraged in construction. To be self-sufficient in production of at least 2 dozen products.

- Hetauda and Udayapur cement factories to be made more efficient.

- Local products to be promoted.

- Import of luxury goods and health-unfriendly products to be discouraged.

- Economic zone to be established in Kavre and Nuwakot. 50% concession to Nepali textile industry on electricity.

- Infrastructure development at trade transit points in the north. Business with third counties to begin via Chinese port.

- Complete pending works on pipeline by the next year to facilitate import of petroleum products.

- ENERGY: At least two big hydropower projects in all seven provinces. 13 bn allocated for Budhigandaki, 2.02 bn for Budhiganga. Tamor project to be a National Pride Project. Province 2, Karnali Province and Sudurpaschim Province to have ‘full-access’ to power/electricity.

- 4.5 bn for rural electrification. Waste-to-energy to be encouraged.

- TRANSPORTATION: 163 bn appropriated for Railway and Waterways. Digital cards for payments for public transport. 1.5bn for transport management. Electric buses to be introduced in ‘major’ cities. NEA to install charging stations.

- Additional budget for development of Narayani and Koshi waterways.

- URBAN DEVELOPMENT: Feasibility study to be conducted for development of Mega-city and Smart-city. 530 million allocated to replace thatched roofs of 20,000 houses. 4.3 bn for construction of 30,000 houses under housing project.

- Convention centre with a capacity to accommodate 3,000 people to be constructed in the Valley, this year. City halls to be constructed in local levels. Compulsory footpath, underground cable management.

- 47.7 bn allocated for housing and urban development.

- MP’s constituency budget (MP fund) increased to Rs 60 million.

- 1 bn for Dharahara reconstruction (to be completed within the next two years). 141 billion appropriated for reconstruction. 9 bn for infrastructural development in each electoral constituency.

- Online visas for foreign nationals.

- National Defence University to be established.

- 18-20% (non-gazetted-gazetted) increment in salaries of public service personnel.

- National Knowledge Centre to be established at Khumaltar. Tribhuvan International Airport to be upgraded to a boutique airport. Gautam Buddha International Airport to come into operation next year.

- Contractors to be held responsible for the upkeep of their projects for five years after completion.

- VAT and other taxes to be made more effective through improved taxation system. VAT rates to stay intact. Changes in customs rate. Reduction in import reliance.

- Budget size: 1.53 trillion, Recurrent Budget: 957.1 billion, Capital Expenditure: 408.59 billion, Financing: 167.5 billion